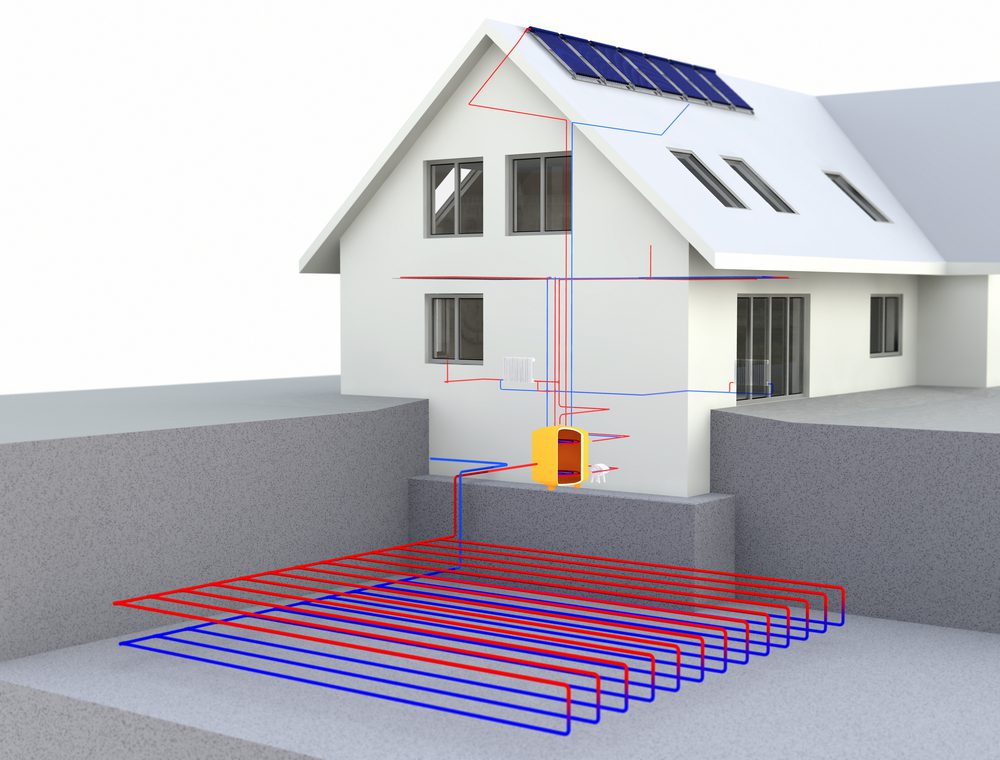

Installing geothermal heating and cooling systems in your existing or under-construction home in Delaware and Maryland can reduce your energy costs by up to 70%. This makes the systems a popular option, especially since many geothermal heating and cooling systems qualify for a tax credit under the American Recovery and Reinvestment Act of 2009 (ARRA).

If you have ever considered installing a geothermal heating or cooling system in your home, however, keep in mind that the tax credit is currently only in effect until December 31, 2016.

FAQS ABOUT THE TAX CREDIT FOR GEOTHERMAL HEATING AND COOLING SYSTEMS

It might seem confusing when you visit the IRS Energy Incentive for Individuals page when researching the tax credits that are available for installing a geothermal heating and cooling system. This is because the ARRA offers varying amounts of tax credits for different types of energy-efficient home improvements.

HOW MUCH IS THE TAX CREDIT FOR INSTALLING GEOTHERMAL HEATING AND COOLING SYSTEMS?

Geothermal heating and cooling systems are considered alternative energy equipment, as opposed to simply being energy-saving equipment. The ARRA provides you with a tax credit of 30 percent of the costs of a qualifying geothermal heating and cooling system with no dollar limit on the amount of the credit.

In comparison, adding energy-saving improvements, like installing new windows or doors, to your home provide a 30 percent credit of the cost of the improvements with a credit limit up to $1,500.

ENERGY INCENTIVES IN DELAWARE

In addition to federal tax incentives for energy-efficient home improvements, many states also offer their own incentives. Residents of Delaware may qualify for grants and tax credits when they install green technology in their homes. To find out more, visit the State of Delaware’s Energy Tips and Assistance page.

GETTING PROFESSIONAL TAX ADVICE

To get the maximum tax benefits of improving the energy-efficiency of your home, talk to an experienced tax professional. Depending on the improvements, you might qualify for several different tax incentives for the work completed.

If you would like to discuss your options for installing a geothermal heating and cooling system in your house, contact First Class HVAC today. We are a fully licensed heating, cooling, and plumbing company serving Sussex County, Kent County, and New Castle County in Delaware and Maryland.